Hidden Auctions

Last Updated on 28. April 2023 by Martin Schuster

In 2021, Vitalik Buterin pointed out some hidden auctions regarding NFTs. You can read the write up here: https://vitalik.ca/general/2021/08/22/prices.html

In some cases, NFTs and ICOs don’t apply auctions to sell their tokens or coins. Sometimes, they sell it below the market-clearing price. There are some reasons why this could be rational, even if the seller misses some profit.

- Setting up an auction is more difficult than selling it for a fixed price.

- Sellers want prices to go up. So, if they set it at the market-clearing price, the risk is higher that the price goes down, resulting in complaints and maybe a bad market recognition.

- A low price attracts more people and creates a perception of scarcity. Although the same is achieved with a higher price (prices reflect scarcity), long queues are more visible.

- Sellers want to avoid the impression of being greedy.

The idea behind that might be noble, but the effect might be totally the opposite. If the price is lower than the market-clearing price, those people who can submit their buy transaction first have an advantage. Those, who submit their transaction a bit too late, go away empty-handed.

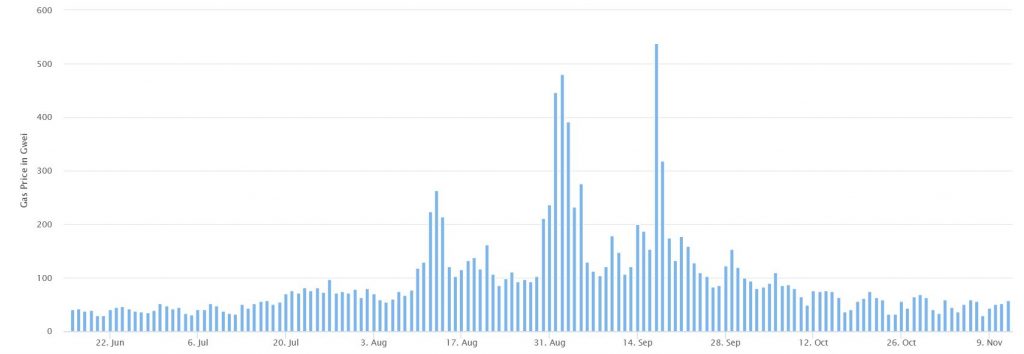

We can see frequent gas price spikes in Ethereum caused by token sales.

Being the first can be achieved by high transaction fees. The higher the fee, the sooner a transaction is included in a block. And as we saw, the transaction fee market is an auction. In the end, those buyers with the highest transaction fees win. And those who don’t want (or can) pay those high transaction fees to lose. In this case, the token seller could have set up an auction himself. The only difference now is that he doesn’t earn the margin, but instead, the miners reap the margin through their transaction fees.

Register

Register Sign in

Sign in