PoS – DeFi Canibalization

Last Updated on 28. April 2023 by Martin Schuster

PoS relies on users that stake their Coins and contribute to the consensus mechanism. Most PoS blockchains are secure as along as more than 2/3 of all stakers are honest. In order to gain more than 1/3 of the total staked amount, there are two avenues:

- Buy the necessary coins and stake them

- Reduce the total amount of staked coins

The first approach, buying the necessary coins, is very expensive. That’s why we focus on the second one. But how could we reduce the number of staked coins? Rational stakers look for the most profitable way to invest their coins. If we offer a higher yield for their coins than staking does, they will transfer their coins away from staking to our service. This means that the network becomes less secure.

But it can get even worse. If former stakers lend their cons to the attacker, he can use those coins to stake them. The attacker only needs to pay the difference between staking reward and interest rate from my own pocket, which is likely to be less expensive than buying a large number of coins.

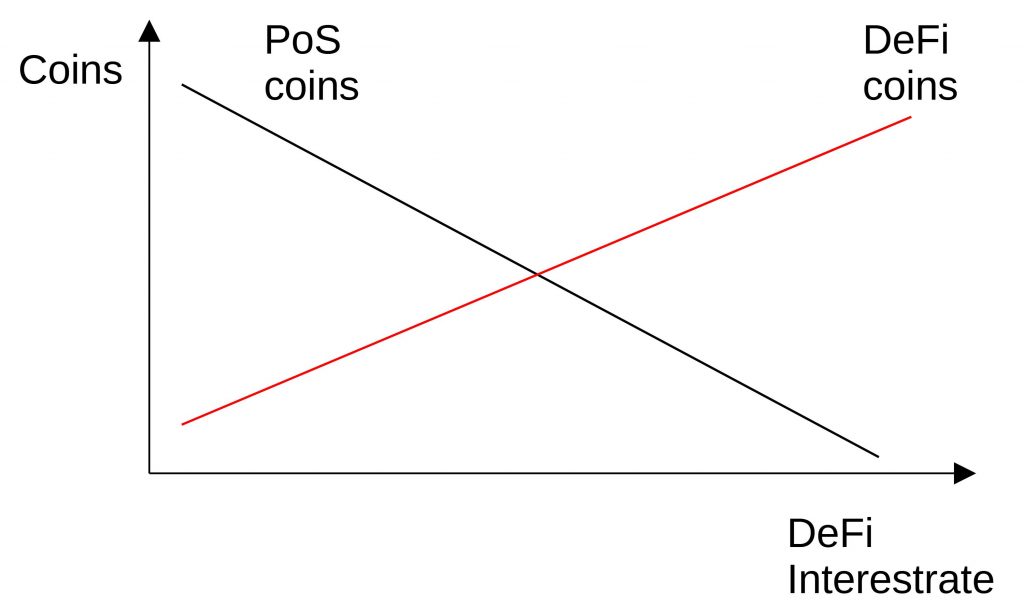

Equilibrium

If we assume that both types of investment bear the same risk, the market should come to an equal interest rate in both sectors. If the DeFi interest rate rises, stakers flock to DeFi contracts. Since the total block reward remains untouched, fewer stakers receive the same amount which means a higher yield per staked coin. The drain lasts as long as there is a difference in the interest rates.

Register

Register Sign in

Sign in