Overview over Decentralized Lending

Last Updated on 3. May 2023 by Martin Schuster

Decentralized lending is an exciting field in decentralized finance. It allows borrowers to borrow tokens or assets in general on a blockchain. Lenders can earn income by providing liquidity and earn interest or fees.

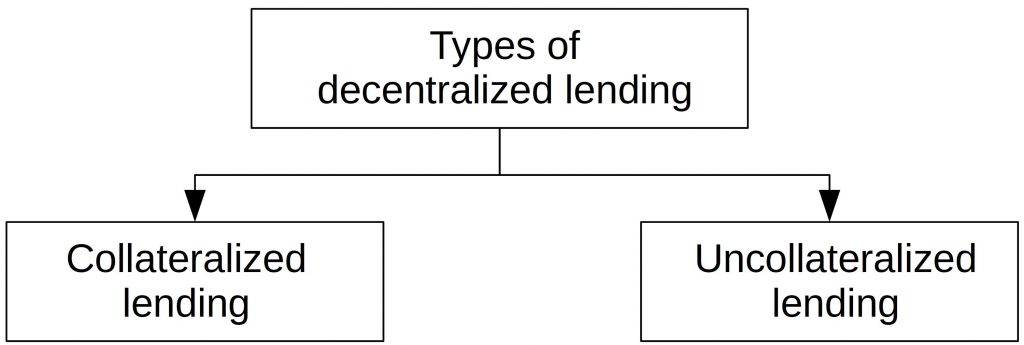

Types of Decentralized Lending

Decentralized lending services can be distinguished into two basic types, collateralized lending, and uncollateralized lending.

Collateralized Lending

When taking a traditional credit, the bank usually asks for proof of income, and your identity before granting the loan. This reduces the default risk. If you should fail to pay the loan back, it will take legal measures like seizing your income or car. This works because the bank knows where to find you. This scheme is somewhat based on trust.

In a blockchain setup, there is no identification possible. That’s why trust-based lending doesn’t work. Therefore, the borrower has to provide collateral. And if he doesn’t pay back the loan within a given time, the collateral is sold by the lender. It works like a pawnshop where customers swap their valuables (watches, jewelry, etc.) for cash.

In most cases, the collateral is worth more than the actual loan value. Typically, decentralized lending platforms require minimum collateral of 150 % worth of the loan value. This should help to set off impairments due to volatile market rates.

Another measure lenders can take is automated liquidation. As soon as the value of the collateral falls below a certain threshold (e. g. minimum collateral), the lender sells the collateral. This shifts the volatility risk to the borrower.

As you can see, collateralized lending can be risky for the borrower. And it is not clear why he should take a loan at all if he could sell the collateral tokens and avoid interest and transaction fees.

Uncollateralized Lending

Uncollateralized sounds a bit odd after learning that blockchain-based lenders have no means to collect the debt if the borrower fails to pay its loan back. But it works if the payout and repayment happen in the same transaction. Between the payout and the repayment, the borrower can use the funds to trade or do whatever he wishes to do.

If the repayment fails, the whole transaction fails and the borrower doesn’t receive the payout in the first place.

This is called a flash loan.

Register

Register Sign in

Sign in